direct vs indirect cash flow gaap

The indirect method will require additional adjustments to the cash flow statement. Adjusting net income for non-cash expenses is one of the steps involved in the indirect method for preparing cash flows from operations.

Us Gaap Vs Ifrs Accounting Education Accounting Student Bookkeeping Business

The direct method is one way for a company to prepare its cash flow.

. The direct method of accounting is generally more accurate than the indirect method. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Identifying how much cash was received from customers.

The indirect method is relatively complex method as compared to the direct method as it utilizes net income as the base and performs necessary cashflow adjustments. A direct method which shows specific operating cash inflows and outflows and b indirect method which starts with. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows.

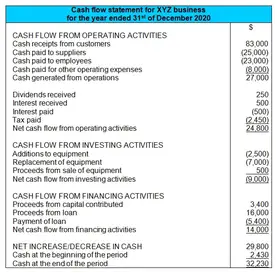

Dec 312016 Dec 312015 Cash flow from operating activities Cash received from customers 25900 23478 Cash paid to suppliers and employees 15658 17534 Dividend received 1200 178 Net. The indirect method by contrast means reports are often easier to prepare as businesses typically already keep records on an accrual basis which provides a better overview of the ebb and flow of activity. The direct method lists the cash receipts and cash payments made during the accounting period.

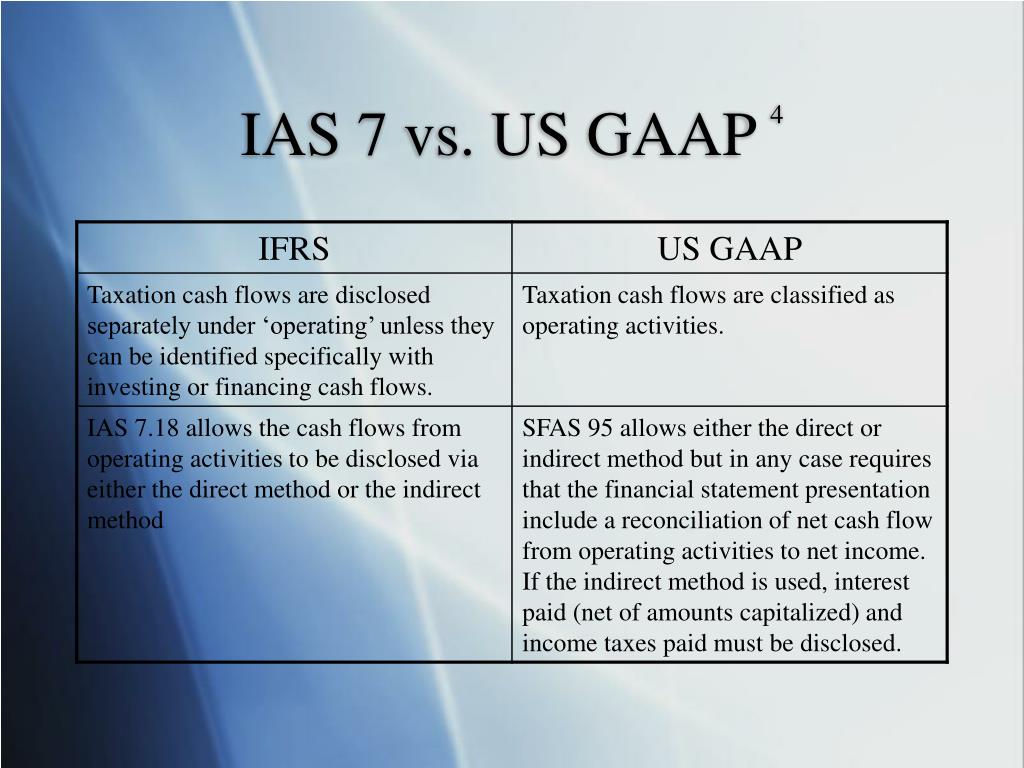

106 Both encourage the use of the direct method. Determining how much cash was paid for income taxes. IAS 7 and Section 230-10-45 FASB Statement No.

Accounting standards allow two presentation formats. The indirect method uses accrual accounting information. Both the Direct and Indirect methods require that cash flows be classified into three categories.

Below you will find an example of the cash flow from operations segment of a cash flow statement prepared under IFRS using the direct method. The direct method is a way to present and prepare the statement of cash flows by listing the operation cash receipts and payments in the cash from operations section. An indirect method has low accuracy since a lot of adjustments to the cash flows are required.

Up to 5 cash back 5412 Comparison with the Reconciliation Method under US. Operating investing aka discretionary and financing. The accuracy indirect method is high due to a lack of any adjustments that are required.

To perform this calculation begin with net income add back non-cash. Although the FASB favors the direct method accountants tend to prefer the indirect method because it can be accomplished much quicker than its counterpart. GAAP also calls the indirect method the reconciliation method.

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. Options B and C present steps that are involved in the direct method. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

There are no presentation differences between the methods in. The key differences between the Direct vs Indirect Cash Flow Methods are as follows. The direct method takes various cash activities.

95 permit the direct and the indirect method of reporting cash flows from operating activities. The indirect method is a method for creating a statement of cash flows a company may use during any given reporting period. One of the adjustments can be regarded as the treatment of non-cash expenses.

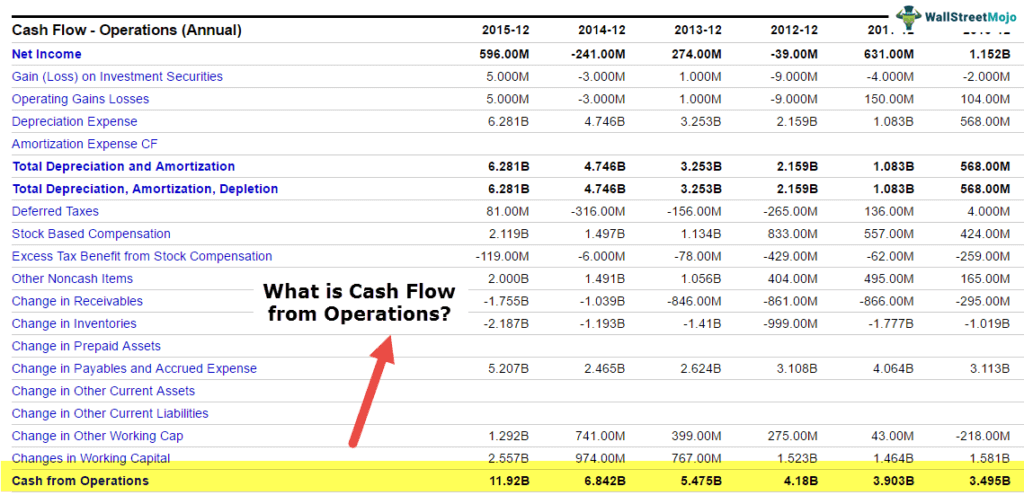

Operating activities however are treated very differently. The correct answer is A. The cash flow statement CFS provides information about a companys cash receipts and payments from operating activities investing activities and financing activities.

The direct method of cash flow statement takes more amount of time to prepare than the indirect method of cash flow statement. Its also more widely used so should be more familiar to investors and its better-suited to large firms with high transaction. The investing and financing categories are treated the same under both methods.

108 In addition unlike.

Operating Expenses Opex Definition And Formula

Cash Flow Statement Finance Train

Cash Flow Statement An Overview Sciencedirect Topics

Direct Vs Indirect Cash Flow Method

Cash Flow From Operating Activities Cfo Definition

Pdf Statement Of Cash Flows Assignment Classification Table By Topic Topics Questions Brief Exercises Exercises Problems Concepts For Analysis Mariam Nawawieh Academia Edu

Cash Flow From Operations Formula Example How To Calculate

Ppt Ias 7 Statement Of Cash Flows Powerpoint Presentation Free Download Id 5634145

Cash Flow Statement Dividends Paid Under Financing Or Operating Activities

27 Understanding Cash Flow Statements

How Is Operating Cash Flow From The Cash Flow Statement Related To Fcf I E Used In Dcf Quora

27 Understanding Cash Flow Statements

Direct Vs Indirect Cash Flow Methods

Intermediate Accounting Chapter 5 The Income Statement And

27 Understanding Cash Flow Statements

Three Types Of Cash Flow Activities Online Accounting